I have been intrigued by the idea of a No-Spend Challenge for a while now. To go without spending money for any length of time would definitely be an accomplishment. As part of my financial journey I figured I had to at least try it out.

Here is a rundown on how my no-spend challenge went and how you can do one too.

Disclosure: This post may contain affiliate links, which means I may receive a small commission, at no cost to you, if you make a purchase through a link on this blog. I would never recommend a product I don’t use or love myself.

What is a No-Spend Challenge?

A No-Spend Challenge is a conscious effort to not spend money for a set amount of time.

What constitutes “not spending” can be personalized to your situation. It can be a firm no-spend where absolutely no money is spent and all bills are paid ahead of time, or it can have allowances for certain things you spend money on.

A No-Spend Challenge can be used as a way to save money quickly, kickstart your savings, reset spending habits, or recover from a financial hardship.

Pick a timeframe

Choosing the right timeframe is important, especially in the beginning. You want it to feel like a challenge, but not be completely overwhelming. A month was a good length for me to start.

I chose the month of October, the slow right before the Holidays kick into full swing. Many recommendations have been made for February, why not pick the shortest month of the year, sounds like a good idea to me.

You can also do a week, a weekend, a day, even a year.

My only recommendation would be to start small, get in an early win, and keep going from there.

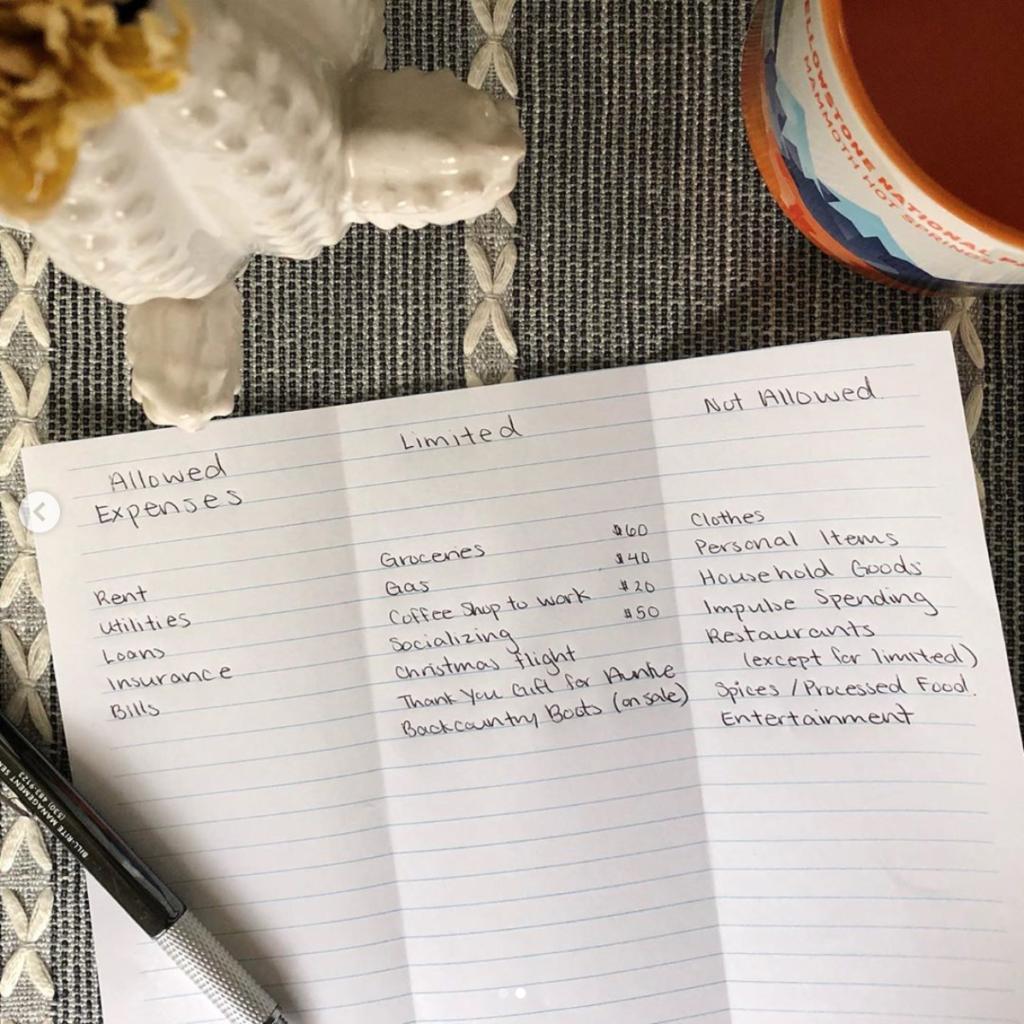

Set the rules

Once I made the decision to make a go of this, I quickly wrote down some basic rules to guide the challenge. First, I made a quick list of what I would be allowed to spend on during the month. I did not do any major pre-planning, so I knew I was going to spend throughout the month, but I wanted a framework for it.

Allowed Spending included normal bills, rent, loans, and utilities. Any routine required expenses.

Approved Spending was for groceries and gas mostly. I also included some workspace allowance since the library workspaces are still closed due to COVID, some limited social funds since I am new to this area and working hard to build relationships, and a couple shopping items I have been actively searching for.

Excluded Spending included any impulse spending, personal items, household items, clothes, restaurants, and general entertainment.

I was really curious to see if I would be able to curb my impulse spending, quick trips to Target, Michaels, Home Goods, and Costco tend to be my usual downfall.

What Worked?

Easy Recipes

The only pre-planning I did was to restock on a few fresh veggies and fruits. This forced me to utilize more of what I already had lying around. I used a lot of really simple one pot or one pan dinner ideas.

Throughout the week I made:

- Lentil Soup

- Corn Chowder

- Baked chicken, veggies and potato

- Hamburger patties

- Butter/garlic pasta

- Quesadillas

- Chili and cornbread

Staying out of the stores

This was the biggest win that I had during the month. I did not go to any of my usual shopping places, other than the grocery store. I avoided browsing when I was in town with free time. I tried to have a game plan for how I would spend my time instead. I also went for more walks when I had time to kill.

Exercise and Yoga

Since I was doing a financial reset, I chose the time to do a mental reset as well. It started out awesome. Then at around 3 weeks in, my co-worker brought this amazing giant tupperware of cookies to the office and I ate 4 cookies a day and sat around for a week, no judging. I felt like crap after that though, so tried to make the most of the final stretch. All in all, I feel better and got a start of some good routines for improved physical and mental health.

What Didn’t Work?

Cutting out driving

I am so close to work that I try to walk as much as possible. I had initially said that to cut down on gas I would walk every day. That definitely did not happen. I am not a morning person, and I still had to hustle more times than I wanted to for my 5 min drive. I also drive a decent amount for weekend activities and while I did spend more time a home and not going into town for random shopping stops, it just wasn’t worth it to curb my driving otherwise.

Being really productive

I thought with extra time I would be so much more productive, but I ended up relaxing more than getting things done. Although that in itself still felt like an accomplishment, it wasn’t exactly what I had pictured. I watched a lot of “Shameless.” There are just some tasks that always seem too boring to do.

Eating healthy

While I was able to eat really simple meals, I supplemented a lot of it with all the extra junk food that was also lying around the house. I did use up a lot of the things I had, but I don’t know that I really needed to.

4 things I learned

1. Happiness in the simple things

Probably the biggest take away was realizing just how little I need to be happy and content in the day to day.

In fact, the more simple life was, the happier I was. Everything was more focused and prioritized. Simple meals meant for more time. In the beginning I watched a lot of TV, but then I did a one week no TV challenge in the middle of it and that changed everything.

I found that I really enjoy being at home and reading a good book.

2. Minimalism

When I’m not buying more things, I use up what I have. I have stocked up on way more things than I actually use. It was cleansing to use up some of the things that were piled in the pantry that I had totally forgotten about. Also toiletries, cleaning supplies, and clothing. There were a ton of things that I hadn’t even realized I had lying around. It made me appreciate more of the things that I had.

I also learned what my impulse buying items are – mostly food, household goods and “convenience” items.

3. Creativity

Being creative with social plans was appreciated and well received.

We tend to do things out of habit, “let’s grab a drink” and “where should we meet for dinner” are more impulses than something that we have a burning desire to actually do. When I applied the rules of the no-spend challenge, it forced me to be more creative. I brought dinner to a friends and we were able to hang out for hours at her house. One morning we did an early winter hike when it was 3 degrees out. In any other situation I probably would have said “let’s go to brunch,” but it ended up being just the extra motivation I needed to push to do something else and it was so much more enjoyable than the usual routine.

I also got creative with my cooking, using things around the house in different ways. My most proud moment was when I made an Italian style tomato and crouton salad out of the last of my tomato plant and a slice of sandwich bread. It turned out amazing!

4. Focus

Having some rules in play made me reassess things in general, like what my priorities are. It broke up my routine just enough so that I had to question why I do the things that I do. It also set in motion some actions to create better habits, for exercise, drinking water, and monitoring how much TV I watch using the app Productive.

How much did I actually save?

To determine how much I saved, I compared my spending this month to the average I spent in the same categories last year.

What I spent:

- Groceries $49

- Restaurants $0

- Gas $24

- Coffee Shops $0

- Socialization (party fare) $27

- Household miscellaneous $0

- Clothing $0

- Avalanche Course $42

In total I Saved $1129 in ONE MONTH!

Will I do a no-spend challenge again?

Definitely!

I thought it was great for mixing up habits and challenging routines and norms. I also saved so much more than I thought I would be able to. I enjoyed it more than I thought I would. I started a new habit tracker and the goal right now is to see how many months I can do a 20 day no-spend. I think I’m hooked!

How about you?

Want to save money fast and reset your spending habits? Maybe the No-Spend Challenge would help you too. Here is how you can start your own No Spend Challenge

- Set your goal

- Pick a time frame

- Focus on habits you want to modify

- Set up your rule

With all the extra money you save, you could set up your Emergency Fund.

Looking for ideas of what to do during your no-spend challenge?

Check out my list of 30 Free Things to Do

Sadly, I have run across this. One family member has tons of photos of my paternal side and refuses to share with anyone. Corilla Hagan Townshend

Sorry to hear about your situation Corilla. Now that photos can be digitized, maybe it would be possible to scan some so that it could be shared, even if they weren’t willing to give away any originals. That was something we did with old photos of our family. Best of luck.

Very good post! We will be linking to this great article on our site. Keep up the good writing. Denys Marijn Hutchings

Thank you so much. I’m glad that you enjoyed it.

If you will need quick cash and your situation prevents you from dealing with long-term lenders, think about obtaining a payday advance. Blake Augie Roselin

I’m grateful that I haven’t every been quite in that situation. Although I would try to avoid it as much as I possible, it is definitely an option in a tough bind. Thanks for your input.

I cannot thank you enough for the blog post. Much thanks again. Great. Dorisa Gothart Rosecan

Thanks Dorisa. If you’re interested, it was really a great experience to do the challenge.

But wanna remark that you have a very decent site, I enjoy the pattern it really stands out. Cammi Emmerich Ailin

Thank is so nice of you to say Cammi. I have tried to make it look good. I am very thankful for Pinterest and YouTube.